- JPMorgan has seen hackers’ attempts on the firm ramp up this year, an exec said Wednesday.

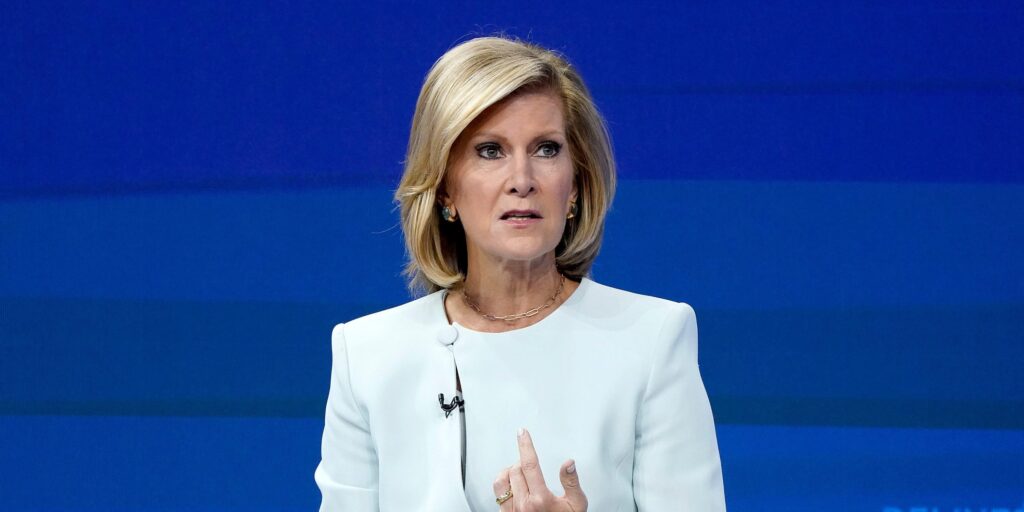

- Mary Callahan Erdoes, who leads JPMorgan’s asset and wealth management unit, said hackers are getting smarter.

- The firm spends $15 billion a year and employs 62,000 staffers to defend against hackers.

Hackers are getting smarter and increasingly keen on infiltrating JPMorgan, according to Mary Callahan Erdoes, the bank’s asset and wealth management chief.

In a Wednesday panel at the World Economic Forum conference in Davos, the executive said the observed activity collected from internal monitoring has ramped up significantly.

“The fraudsters get smarter, savvier, quicker, more devious, more mischievous,” she said. “It’s so hard and it’s going to become increasingly harder and that’s why staying one step ahead of it is really the job of each and everyone of us.”

The activity isn’t always targeted and is sometimes automated, a JPMorgan spokesperson told Bloomberg. A 2023 KPMG survey of bank executives found that more than two-thirds of respondents considered cybercrime a top concern moving forward.

Hackers aside, JPMorgan is coming off a banner year. It reported $49.6 billion of net income in 2023, beating its own record set in 2021 and marking a bigger annual profit than any other US bank in history.

Net interest income, or the ratio of what banks earn on loans and pay back on deposits, helped fuel those lofty numbers thanks to a surge in interest rates and higher revolving credit card balances, the company said.